Warren Buffett is building up a ‘recession resistant’ energy powerhouse

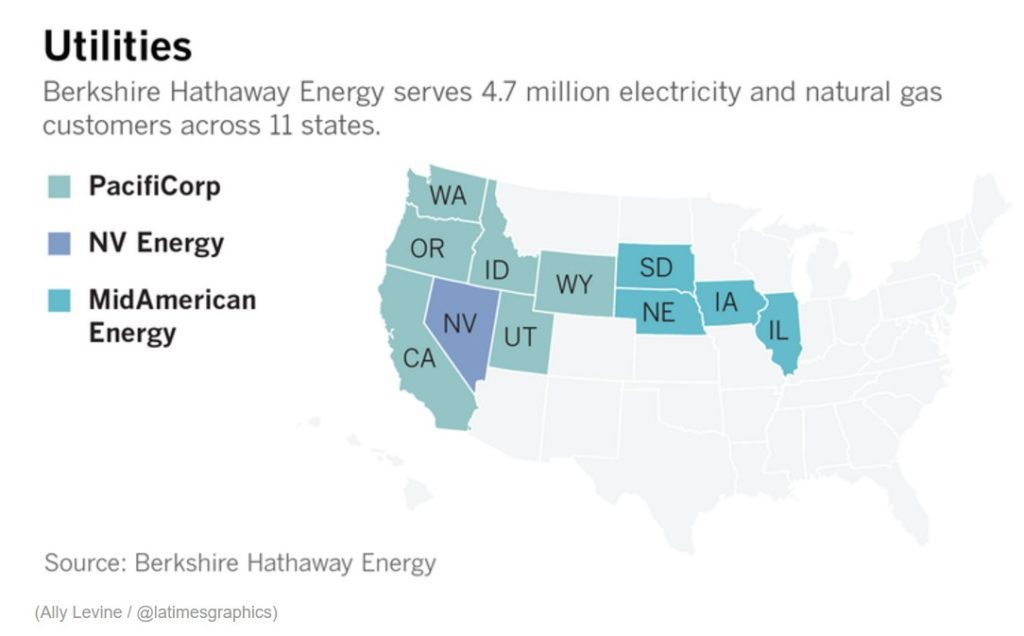

From California to the Midwest, billionaire investor Warren Buffett is steadily building an energy powerhouse.

Buffett’s Berkshire Hathaway Energy subsidiary has gobbled up utilities and natural gas pipelines and tapped into clean energy production, including from Southern California’s abundant geothermal resources.

The latest move by Berkshire Hathaway Energy is the planned $9-billion purchase of Dallas-based Oncor, a regulated electricity service provider with 10 million customers and more than 3,700 employees. It’s one of the nation’s largest power transmission companies.

“Oncor is an excellent fit for Berkshire Hathaway, and we are pleased to make another long-term investment in Texas,” Buffett said in a statement announcing the deal, which is expected to close by the end of the year. ”When we invest in Texas, we invest big!”

Buffett’s big investment amps up an energy operation that last year contributed nearly 10% of Berkshire Hathaway’s $24 billion in earnings.

Buffett views utilities and their earnings as “recession resistant,” providing “an essential service for which demand is remarkably steady,” the so-called Oracle of Omaha told Berkshire Hathaway shareholders in the latest version of his famous annual letter.

Berkshire Hathaway Energy declined to make anyone available to comment for this report.

Jon Wellinghoff, former chairman of the Federal Energy Regulatory Commission, said he believes Berkshire Hathaway recognizes that there are many areas of the electrical grid that operate inefficiently and — like any business — it is looking to capitalize on that.

“There are tremendous efficiencies to be squeezed out of the system,” said Wellinghoff, a former chief policy officer at SolarCity who is chief executive of consulting firm Policy DER.

“I think Berkshire Hathaway’s strategy is to maximize the use of the transmission system,” he said. “I also think it can be and ultimately will be a good use of renewable energy.”