Electricity Consumption Continues To Fall

Electricity sales in 2016 fell, the sixth year in the past ten in which America’s electricity users managed to do with less. Industrial firms made the sharpest cuts in their electricity usage. Their consumption fell in seven of the past ten years.

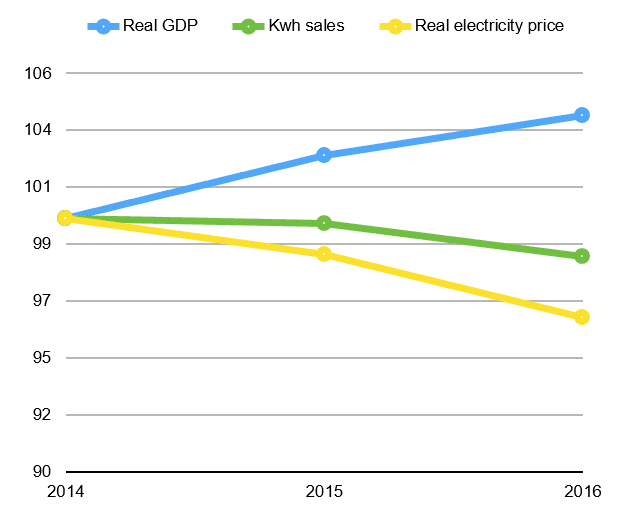

The 1.3 percent drop in total consumption in 2016 looks small but it comes despite economic growth and lower real price of electricity. Okay, economic growth has not been robust and the real decline in price small, but electric sales always used to go up when the price of electricity declined and the economy grew.

In economic parlance, electricity had a negative price and positive income elasticity. In the old days a 1.6 percent improvement in real gross domestic product (GDP) and a 2.5 percent real price decrease together should have spurred consumers to use at least 1-2 percent more electricity. But, with similar conditions in both 2015 and 2016, kWh sales declined in both years.

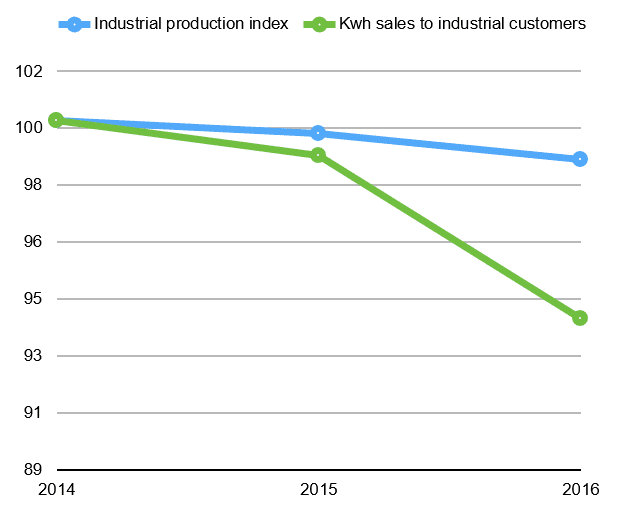

The picture for industrial usage is even more puzzling. Industrial users consumed 5.1 percent less electricity in 2016. Industrial users have been cutting back for years. Admittedly, the industrial production numbers have been weak, but sales of electricity to industrial customers has been far weaker as seen in Figure 2.

Almost fifty years ago, during a previous Energy Crisis, price of electricity shot up and demand for it fell. But industry people associated the sales drop with a patriotic fervor and a desire to limit our dependence on Middle Eastern oil (even though electricity doesn’t come from the Middle East and domestic coal was the main electric boiler fuel).

Eventually, the utility industry got the message. Sharp price increases have consequences. We have no doubt that a competent econometric analysis would tease out the impact of price and economic condi-tions on the past year’s electricity sales and show that price and income still matter, but we suspect that other factors are presently swamping the orthodox explanations for growth or the lack of growth, such as changes in population mix (the over 65 cohort is the fastest growing sector of the population), the increas-ing efficiency of lighting and appliances and the decline of domestic manufacturing.

Newer control devices will determine consumption patterns, using algorithms that take into account cur-rent price and conditions on the grid. Consumers will not have to think about what they want to do, which will make it easier to adjust usage more frequently.