EIM Benefits up 8% in Q4 with APS, Puget Sound Additions

February 2, 2017

By Robert Mullin

The Western Energy Imbalance Market (EIM) saw total financial benefits grow 8% during the fourth quarter of 2016 with the addition of Arizona Public Service and Puget Sound Energy as participants, according to a report released by market operator CAISO.

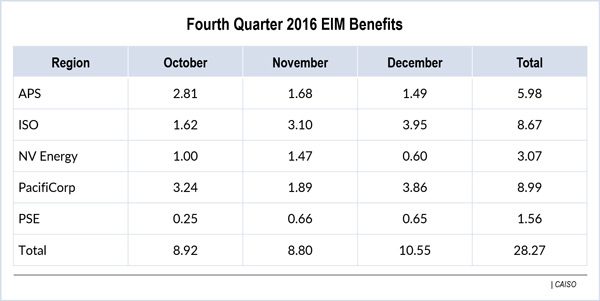

The EIM generated gross benefits of $28.3 million during the quarter, up $2.1 million from the third quarter. The increase came despite typically lower electricity demand in the EIM area during the fall months, the ISO said.

The market has yielded $142.6 million in benefits for its members since being launched in November 2014, the ISO estimates.

EIM operations also helped to displace more than 10,000 metric tons of greenhouse gas emissions during the fourth quarter by enabling the dispatch of 23,390 MWh of surplus renewable energy output from California that would have otherwise been curtailed.

“That avoided curtailment is effectively being used to meet energy needs across the Energy Imbalance Market, and it basically is displacing emitting resources potentially elsewhere in the footprint,” Mark Rothleder, CAISO vice president of market quality and renewable integration, said during a Feb. 1 meeting of the EIM’s governing body.

Rothleder also said that the ISO predicts avoided curtailments to rise sharply with increased renewable energy production during late winter and spring that this year. That seasonal pattern will be compounded by increased hydroelectric output stemming from an unusually high water year. The uptick in generation will coincide with low seasonal loads for California and the rest of West.

10-Year Peak for Hydro

Casey Cadle, a real-time operations shift manager for the ISO, said that California faces the heaviest hydro conditions in 10 years. “We’re also going to be having more solar than we’ve ever had in our system, so it’ll be an interesting time of year for us,” Cadle said.

CAISO’s report showed a more even distribution of EIM gross benefits among members compared with the third quarter, when Portland-based PacifiCorp reaped more than half the total among the three participants, which at the time included just NV Energy and the ISO. (See PacifiCorp Increases Share of EIM Benefit in Q3.) APS and PSE began transacting in the market Oct. 1, 2016. (See Arizona Public Service, Puget Sound Energy Begin Trading in the EIM.)

The fourth quarter saw PacifiCorp realize almost $9 million in benefits, compared with $8.7 million for CAISO, $5.9 million for APS, $3.1 million for NV Energy and $1.6 million for PSE.

The benefits represent either cost savings — for example, the reduced need for reserves and greenhouse gas credits — or increased profits from merchant operations. The market’s ability to reduce curtailments also enables participants to collect renewable energy credits that would not otherwise be issued.

The benefits calculation nets out inter-balancing authority area (BAA) transfers that were scheduled ahead of the EIM’s 15- and five-minute market runs to avoid attributing contracted flows to the market.

Arizona ‘Freeway’

The report also showed that a significant amount of energy flowed from the PacifiCorp-East BAA into APS, and then again from APS into CAISO, suggesting that the Arizona utility’s transmission network is fulfilling its potential of becoming a major transit point between the interior West and California based on its ample transfer capability. (See Smooth EIM Transition for Arizona Public Service, Puget Sound Energy.)

“We can transfer a lot back and forth with PacifiCorp, NV Energy and the California ISO,” Justin Thompson, APS director of resource operations and trading, said last year after the company began operating in the market. “We’re kind of the freeway of the EIM system there.”

Rothleder noted that the prevailing transfers during the fourth quarter came out of PacifiCorp-East, with additional supply being picked up on parallel paths crossing Nevada and Arizona for delivery into California. Some flows continue north into the PacifiCorp-West BAA in Oregon.

The middle of the day often brings a reversal, as CAISO exports its excess supplies to inland areas.

“So there’s times where California is pushing and transferring back out to Arizona, to Nevada and on to [PacifiCorp-East], and that’s exactly how the Energy Imbalance Market is supposed to work,” Rothleder said.